Contents

- 1 Jeff Bezos’ Humble Beginnings in Albuquerque

- 2 Education at Princeton University

- 3 First Steps into the Professional World

- 4 Transition to Wall Street

- 5 Rising Through the Ranks at D.E. Shaw

- 6 The Idea That Changed Everything

- 7 Leaving D.E. Shaw to Pursue a Dream

- 8 The Cross-Country Road Trip to Seattle

- 9 What Did Jeff Bezos Do Before Amazon? A Summary

- 10 Bezos’ Early Career and Its Impact on Amazon

- 11 Lessons from Bezos’ Pre-Amazon Journey

- 12 Bezos’ Influence Beyond Amazon

- 13 Reflecting on Bezos’ Early Career Choices

- 14 Bezos’ Legacy: From Early Career to Global Impact

- 15 The Evolution of Jeff Bezos: A Look Back

Long before he became a household name, the founder of one of the world’s largest companies had a fascinating journey. Born in Albuquerque and raised in Houston and Miami, his early years were marked by curiosity and a knack for tinkering with electronics.

After graduating from Princeton in 1986 with a degree in Electrical Engineering and Computer Science, he dove into the corporate world. For eight years, he worked on Wall Street, trading stock reports and honing his analytical skills. This experience laid the groundwork for his future success.

In 1994, he made a bold decision to leave his stable job and embark on a cross-country road trip. This journey led to the creation of a small online bookstore in a garage, which would later grow into a global business empire. His time in the financial sector shaped the data-driven culture that defines his company today.

Key Takeaways

- He was born in Albuquerque and raised in Houston and Miami.

- Graduated from Princeton with a degree in Electrical Engineering and Computer Science.

- Spent eight years working on Wall Street before starting his own business.

- His early tinkering with electronics hinted at his future tech prowess.

- The financial sector experience influenced the data-driven culture of his company.

Jeff Bezos’ Humble Beginnings in Albuquerque

Jeffrey Preston Jorgensen’s early life in Albuquerque laid the foundation for his future success. Born to a teenage mother, Jacklyn, and later adopted by his stepfather, Mike Bezos, his upbringing was marked by resilience and curiosity. His family played a significant role in shaping his determination and technical mindset.

Family Background and Early Influences

Jacklyn’s strong work ethic left a lasting impression on her son. She worked tirelessly to provide for the family, instilling in him the value of hard work. Mike Bezos, a Cuban immigrant and engineer, introduced Jeff to the world of technology. His stepfather’s career inspired Jeff’s early interest in computers and problem-solving.

Jeff’s Montessori education further nurtured his independent thinking. This educational approach encouraged him to explore his interests freely, fostering a lifelong love for innovation. These early influences combined to create a young man with a unique blend of curiosity and determination.

Childhood Curiosity and Early Entrepreneurship

From a young age, Jeff displayed a knack for tinkering. At just 12, he built an electric alarm system to keep his siblings out of his room. This project was his first foray into entrepreneurship, showcasing his ability to solve problems creatively.

During high school, Jeff took on part-time jobs, including working the breakfast shift at McDonald’s. These experiences taught him the importance of discipline and time management. By the time he graduated, he had already developed a strong foundation in both technical skills and work ethic.

| Key Influences | Impact on Jeff Bezos |

|---|---|

| Mother’s Work Ethic | Instilled resilience and determination |

| Stepfather’s Engineering Career | Sparked interest in technology and innovation |

| Montessori Education | Encouraged independent problem-solving |

| Early Tinkering Projects | Developed entrepreneurial mindset |

| Part-Time Jobs | Taught discipline and time management |

Education at Princeton University

Princeton University became the launchpad for a future tech titan. Here, he honed his skills, explored his passions, and laid the groundwork for a groundbreaking career. His time at this prestigious institution was marked by academic excellence and leadership.

Choosing Electrical Engineering and Computer Science

Initially, he pursued physics, driven by a fascination with the universe. However, a pivotal moment came when a classmate outperformed him in a challenging physics problem. This humbling experience led him to switch majors to electrical engineering and computer science.

This decision proved transformative. His coursework in computer science became the foundation for Amazon’s tech stack. Trading rocket equations for stock algorithms, he developed a deep understanding of systems and data, skills that would later revolutionize the market.

Extracurricular Activities and Leadership Roles

Beyond academics, he immersed himself in campus life. As president of the Princeton chapter of Students for the Exploration and Development of Space (SEDS), he championed space advocacy. This role showcased his ability to inspire others and think beyond conventional boundaries.

He also took on a leadership role in the Quadrangle eating club, a social organization. Here, he honed his interpersonal skills and learned the art of collaboration. These experiences shaped him into a well-rounded founder and leader.

| Achievement | Impact |

|---|---|

| Graduated Summa Cum Laude | Demonstrated academic excellence |

| Phi Beta Kappa Member | Recognized for intellectual rigor |

| President of Princeton SEDS | Advocated for space exploration |

| Leader in Quadrangle Club | Developed leadership and social skills |

| 4.2 GPA | Set a high standard for future endeavors |

Princeton University was more than just a school for him. It was a place where he discovered his potential, built lifelong skills, and prepared for a journey that would change the world.

First Steps into the Professional World

Fresh out of Princeton, he faced a pivotal career choice that would shape his future. Offers from tech giants like Intel and Bell Labs were on the table, promising stability and prestige. Instead, he chose a different path, one that aligned with his business instincts and appetite for risk.

Early Job Offers and Career Choices

Rejecting the corporate safety net, he joined Fitel, a fintech startup. This decision reflected his willingness to embrace uncertainty for the sake of innovation. At Fitel, he worked on building a global trade network infrastructure, a project that required creativity and technical expertise.

His role involved coding before coffee breaks and solving complex technical challenges. These experiences not only sharpened his skills but also foreshadowed the logistics empire he would later create. By 24, he was promoted to director, showcasing his early leadership potential.

Working at Fitel: Building a Global Network

At Fitel, he tackled the daunting task of creating pre-internet trade systems. This involved designing solutions to connect international markets, a precursor to the global services Amazon would offer. His work laid the groundwork for understanding the complexities of supply chains and customer needs.

This experience taught him the value of persistence and adaptability. It also highlighted the importance of building a robust network, a lesson that would later define his company’s success. His time at Fitel was a masterclass in turning challenges into opportunities.

| Key Achievements | Impact |

|---|---|

| Rejected Intel/Bell Labs Offers | Embraced risk and innovation |

| Joined Fitel Startup | Gained hands-on technical experience |

| Built Global Trade Network | Foreshadowed Amazon’s logistics |

| Promoted to Director at 24 | Developed early leadership skills |

| Solved Pre-Internet Trade Challenges | Mastered problem-solving and adaptability |

Transition to Wall Street

Wall Street offered a unique blend of challenges and opportunities for a tech-savvy mind. In the late 1980s, the financial sector was buzzing with innovation, and it became a money-making playground for those who could crack the code. This was the perfect stage for someone with a knack for algorithms and a hunger for success.

Role at Bankers Trust: Product Management

At Bankers Trust, he dove into product management, developing bond-trading software that streamlined complex financial processes. This role wasn’t just about coding; it was about understanding the nuances of the market and creating tools that could handle billions in revenue. His work here laid the foundation for his future ventures.

By focusing on efficiency and accuracy, he turned financial algorithms into powerful tools. This experience taught him the importance of data-driven decision-making, a skill that would later define his approach to business.

Joining D.E. Shaw & Co: A Turning Point

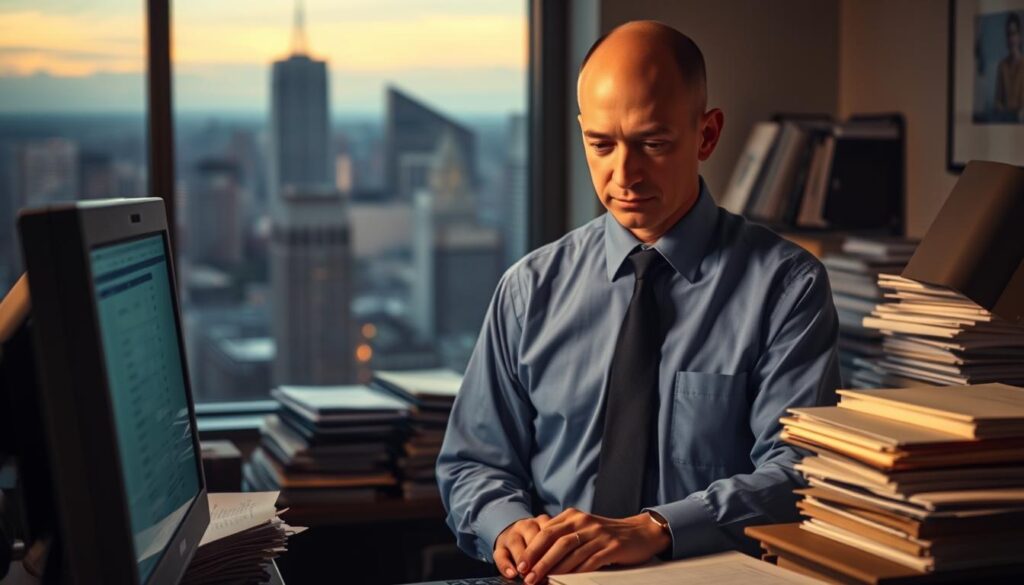

In 1990, he joined D.E. Shaw & Co., a hedge fund known for its cutting-edge quantitative trading strategies. Here, he earned the nickname “human calculator” for his ability to analyze complex financial data with precision. His work involved creating models that could predict market movements, a skill that would later influence Amazon’s dynamic pricing models.

At just 30, he became the youngest senior vice president at the firm. His $300K salary in New York not only funded his lifestyle but also provided the capital for his future entrepreneurial endeavors. This role was a turning point, blending his technical expertise with financial acumen.

- Financial algorithms became his “money-making playground.”

- Known as the “human calculator” for his analytical prowess.

- Quantitative trading strategies influenced Amazon’s pricing models.

- Earned a $300K salary, funding early Amazon investments.

Rising Through the Ranks at D.E. Shaw

Crunching numbers by day and exploring the web by night, he balanced two worlds that would shape his future. At D.E. Shaw & Co., a hedge fund known for its quantitative trading strategies, he quickly made a name for himself. His ability to analyze complex financial data earned him the nickname “human calculator.”

Becoming the Youngest Senior Vice President

By 30, he was promoted to senior vice president, making him the youngest in the firm’s history. Managing an $85 billion fund, he honed his risk assessment skills, which later prevented Amazon’s dot-com collapse. His work involved creating models that predicted market movements, a strategy that influenced Amazon’s dynamic pricing.

Despite a seven-figure salary, he chose to leave. His resignation was driven by a growing fascination with the internet’s potential. This decision marked the beginning of a new chapter, one that would redefine the market and create a company worth billions.

Lessons Learned in Finance and Technology

His time at D.E. Shaw taught him the importance of data-driven decision-making. The hedge fund’s quantitative strategies became a blueprint for Amazon’s logistics and pricing models. He also pioneered research into internet commerce, laying the groundwork for his future ventures.

During this period, he met MacKenzie Scott, who played a crucial part in Amazon’s early operations. Her support and insights were instrumental in turning a garage startup into a global empire. Together, they combined financial acumen with technological innovation to build a company that changed the world.

- Balanced finance work with web growth research, earning the nickname “human calculator.”

- Used hedge fund math to inform Amazon’s dynamic pricing strategies.

- MacKenzie Scott’s contributions were vital to Amazon’s early success.

- Risk assessment skills prevented Amazon’s collapse during the dot-com bubble.

The Idea That Changed Everything

The internet’s explosive growth in the 1990s sparked a vision that changed the business landscape forever. In 1994, a 2300% increase in web usage caught the attention of a Wall Street professional. This statistic became the foundation for a revolutionary idea—an online store that could sell virtually anything.

Recognizing the Potential of the Internet

While working in New York, he saw the internet as a “gold rush 2.0.” Its rapid growth hinted at untapped potential. He envisioned a site that could offer millions of products, accessible from any computer. This concept, later dubbed the “everything store,” was bold and ambitious.

To guide his decision, he used the “regret minimization framework.” This approach helped him weigh the risks of leaving a lucrative career against the opportunity to pioneer a new industry. The choice was clear—embrace the unknown and build something groundbreaking.

Planning the Move from Wall Street to Silicon Valley

Leaving Wall Street wasn’t easy. Trading pinstripes for packing tape symbolized a dramatic shift. He chose Seattle as the base for his venture, drawn by its access to tech talent and proximity to major book distributors. This strategic relocation was crucial for the company’s early success.

During a cross-country drive, he tested the website’s functionality. This hands-on approach ensured the platform was ready for launch. The initial business name, Cadabra, was quickly changed after it was confused with “cadaver.” The rebranding marked the beginning of a journey that would redefine commerce.

- The internet’s growth inspired the “everything store” concept.

- The regret minimization framework guided the leap into entrepreneurship.

- Seattle was chosen for its tech talent and logistical advantages.

- The cross-country drive tested the site’s readiness for launch.

Leaving D.E. Shaw to Pursue a Dream

Taking a leap of faith, he left a lucrative career to chase a bold vision. The decision to abandon a seven-figure salary at D.E. Shaw wasn’t easy. With a 70% chance of failure, the odds were daunting. Yet, the potential of the internet was too compelling to ignore. This moment marked the beginning of a venture that would redefine commerce.

The Decision to Start Amazon

Leaving Wall Street meant trading financial security for uncertainty. He used a “regret minimization framework” to guide his choice. The idea was simple: minimize future regrets by taking risks now. This mindset led to the creation of a small online bookstore, which would later become a global giant.

Early financial modeling played a key role in convincing investors. Despite the high failure odds, the potential rewards were too significant to overlook. This data-driven approach laid the foundation for what would become a revolutionary company.

Support from Family and Early Investors

His parents invested nearly $300,000—a significant portion of their life savings. This family support was crucial in the early stages. His stepfather, Mike, even helped assemble desks in the rented garage that served as the first office. This hands-on involvement showcased the collective belief in the vision.

Initial beta testers included 300 friends and family members. These early users provided valuable feedback, helping refine the platform. Despite maxing out credit cards for server space, the team remained focused on building a scalable solution.

- Left a $1M salary for a 70% chance of failure.

- Parents invested $300K, nearly their life savings.

- First office was a rented garage with DIY desks.

- Initial 300 beta testers were friends and family.

- Financial modeling convinced early backers to invest.

The Cross-Country Road Trip to Seattle

The journey from New York to Seattle was more than just a road trip—it was the start of a revolution. With a laptop and a cellphone, he drafted the business plan that would become the blueprint for a global empire. Coding between rest stops, he turned a cross-country drive into a pivotal moment in business history.

Writing the Business Plan on the Go

Every mile brought new ideas. He tested the site’s loading times on dial-up connections, ensuring it was user-friendly even in the early days of the internet. This hands-on approach allowed him to refine the platform before it even launched.

The first book sold on the platform was Fluid Concepts & Creative Analogies, a fitting choice for a venture built on innovation. This small but significant milestone marked the beginning of a new era in retail.

Setting Up Shop in a Rented Garage

Seattle was chosen for its access to tech talent and proximity to major book distributors. The first headquarters? A 400 sq ft garage. Doors were repurposed as desks, and the team worked tirelessly to bring the vision to life.

This humble setup drew comparisons to Hewlett-Packard’s origins, another tech giant that started in a garage. It was a reminder that even the biggest companies begin with small, determined steps.

- Makeshift office with doors as desks.

- Site tested on dial-up for user accessibility.

- First book sold: Fluid Concepts & Creative Analogies.

- Garage startup compared to Hewlett-Packard’s beginnings.

What Did Jeff Bezos Do Before Amazon? A Summary

Before building one of the most influential companies in the world, his early career was a blend of innovation and calculated risks. From Wall Street to a garage startup, his path was anything but conventional. These experiences laid the groundwork for a business that would redefine the world.

Key Takeaways from His Early Career

His Montessori education fostered independent thinking, which later translated into Amazon’s customer-centric design. His time on Wall Street honed his analytical skills, enabling bold investments in the company’s growth. Leadership roles, like his presidency at Princeton’s space club, foreshadowed his founding of Blue Origin.

Despite a 70% chance of failure, his persistence paid off. Today, Amazon is valued at over $1.6 trillion, a testament to his vision and resilience. These early experiences shaped not just a business, but a global empire.

How These Experiences Shaped Amazon’s Vision

His financial background allowed him to apply hedge fund models to retail, creating dynamic pricing strategies. The startup agility he maintained during Amazon’s early days became a cornerstone of its culture. This blend of Wall Street rigor and tech creativity set the stage for unparalleled success.

From a rented garage to a global powerhouse, his journey is a masterclass in adaptability and vision. These lessons continue to inspire entrepreneurs worldwide.

| Early Influence | Impact on Amazon |

|---|---|

| Montessori Education | Customer-centric design |

| Wall Street Experience | Data-driven decision-making |

| Space Club Leadership | Vision for Blue Origin |

| Startup Agility | Scalable business model |

| Persistence | Overcoming early setbacks |

Bezos’ Early Career and Its Impact on Amazon

The fusion of Wall Street strategies and tech innovation laid the foundation for a global empire. His early experiences in finance and technology shaped Amazon’s unique approach to business, blending data-driven decision-making with a culture of relentless innovation.

Applying Wall Street Strategies to E-Commerce

From his days on Wall Street, he brought algorithmic pricing models to Amazon. These models, originally used to predict stock movements, were adapted to optimize revenue in the e-commerce market. This approach allowed Amazon to dynamically adjust prices, staying competitive and maximizing profits.

Stock-style quarterly reviews were introduced, ensuring transparency and accountability. This practice, borrowed from the financial sector, helped maintain a focus on long-term growth. By treating the company like a portfolio, he ensured that every decision was data-driven and strategic.

Building a Culture of Innovation and Risk-Taking

Amazon’s “Day 1” mentality kept the startup spirit alive, even as the company grew. This mindset encouraged continuous innovation and agility, ensuring that Amazon remained at the forefront of the services industry.

The “two-pizza team” rule was implemented to foster agile development. Teams were kept small enough to be fed by two pizzas, ensuring quick decision-making and efficient collaboration. This structure allowed for rapid experimentation and iteration.

- Failure tolerance enabled bold experiments, like the Fire Phone, which paved the way for future successes.

- Betting the farm on cloud computing led to the creation of AWS, now a major revenue driver.

- By 2025, his net worth reached $209.5 billion, a testament to the payoff of calculated risks.

Amazon’s journey from a garage startup to a global powerhouse is a story of vision, adaptability, and relentless innovation. His early career experiences not only shaped Amazon’s strategies but also redefined the way businesses operate in the digital age.

Lessons from Bezos’ Pre-Amazon Journey

The path to building a global empire was paved with lessons from early setbacks and bold visions. His ability to adapt and see opportunities in challenges shaped the future of one of the world’s most influential companies.

The Importance of Adaptability and Vision

Surviving the 2001 dot-com crash required quick thinking and resilience. He implemented “nuclear winter” survival tactics, focusing on core strengths and cutting unnecessary costs. This period taught the value of adaptability in uncertain times.

The failure of Pets.com became a lesson in diversification. It informed the strategy behind AWS, turning a potential disaster into a money-making powerhouse. This shift showcased the importance of learning from mistakes and pivoting when necessary.

How Early Failures Led to Future Success

Near-bankruptcy in 2002 forced a reevaluation of priorities. The focus shifted to profitability, ensuring long-term sustainability. This decision laid the groundwork for Amazon’s dominance in the e-commerce space.

The Fitel network technology influenced AWS architecture, proving that early experiences can shape future innovations. This “failing forward fast” approach became a cornerstone of Amazon’s culture, encouraging experimentation and learning.

- Survived the dot-com crash with strategic cost-cutting.

- Pets.com failure led to the successful launch of AWS.

- 2002 near-bankruptcy shifted focus to profitability.

- Fitel network tech influenced AWS architecture.

- 2021 space flight realized a childhood dream.

| Early Challenge | Lesson Learned |

|---|---|

| Dot-com Crash | Adaptability in crisis |

| Pets.com Failure | Diversification and innovation |

| 2002 Near-Bankruptcy | Focus on profitability |

| Fitel Network Tech | Influence on AWS architecture |

| 2021 Space Flight | Realization of a childhood dream |

These experiences highlight the importance of resilience and vision. By embracing challenges and learning from failures, he built a company that continues to shape the world. His journey serves as a powerful reminder that setbacks can lead to groundbreaking success.

Bezos’ Influence Beyond Amazon

His ventures beyond Amazon reflect a deep commitment to innovation and exploration. From the stars to the newsroom, his influence extends far beyond e-commerce, shaping industries and inspiring millions.

Founding Blue Origin: A Passion for Space

His childhood fascination with space led to the creation of Blue Origin in 2000. This private aerospace company aims to make space travel accessible through its New Shepard rockets. The 2021 crewed flight, which included his wife Lauren Sánchez, marked a historic milestone.

Blue Origin’s mission connects to his early days as a member of a space club. This passion for exploration drives the company’s vision of a future where millions can live and work in space.

Acquiring The Washington Post: A New Venture

In 2013, he purchased The Washington Post for $250 million, signaling a bold move into media. Under his leadership, the newspaper underwent a digital transformation, tripling its tech staff and launching the “Arc” platform.

The Post shifted its focus from stock tips to subscriptions, emphasizing quality journalism. Today, it boasts over 300 million readers, rivaling Amazon’s vast customer base. This parallel growth highlights his ability to innovate across industries.

| Venture | Key Achievements |

|---|---|

| Blue Origin | New Shepard rockets, 2021 crewed flight |

| The Washington Post | Digital transformation, 300M+ readers |

| Leadership Role | Chairman of both ventures |

| Innovation Focus | Space exploration, digital services |

| Risk Management | Navigated challenges in media and aerospace |

Reflecting on Bezos’ Early Career Choices

The early career choices of a visionary often reveal the foundation of their leadership style. From his Montessori education to his Wall Street experience, every step shaped his approach to innovation and growth. These formative years were marked by a blend of curiosity, mentorship, and calculated risks.

How His Background Shaped His Leadership Style

His Montessori education instilled a “learn by doing” philosophy, which later influenced Amazon’s customer-centric design. This hands-on approach encouraged independent thinking and problem-solving, traits that became hallmarks of his leadership.

At Princeton, he honed his technical skills and developed a passion for computer science. This foundation allowed him to bridge the gap between technology and business, creating a unique leadership style that prioritized innovation and efficiency.

His time on Wall Street further refined his analytical mindset. Working with algorithms and financial models taught him the importance of data-driven decision-making, a skill that became central to Amazon’s success.

The Role of Mentorship and Networking

David Shaw, his mentor at D.E. Shaw & Co., played a pivotal role in shaping his career. Shaw’s guidance and the firm’s culture of innovation left a lasting impact, inspiring his “disagree and commit” management philosophy.

His Princeton connections also proved invaluable. Many of Amazon’s first hires were fellow alumni, creating a network of trusted employees who shared his vision. This early team laid the groundwork for the company’s rapid growth.

Even after leaving Wall Street, he maintained relationships with investors, ensuring a steady flow of capital during Amazon’s critical early years. This ability to leverage his network was key to the company’s survival and success.

- Montessori-inspired “learn by doing” approach fostered innovation.

- David Shaw’s mentorship shaped his leadership philosophy.

- Princeton connections built a strong foundation for Amazon’s early team.

- Wall Street investor relationships ensured financial stability.

- MacKenzie’s operational role was vital in the company’s early days.

Bezos’ Legacy: From Early Career to Global Impact

From a modest $300K investment to a $1.6 trillion valuation, his journey redefined what it means to build a global empire. Today, his company employs over 1.5 million people worldwide, creating more than 1 million jobs since its inception in 1994. This transformation from a garage startup to a world-leading enterprise is a testament to his vision and resilience.

How His Early Experiences Defined His Success

His early career was marked by calculated risks and bold decisions. From Wall Street to Silicon Valley, each step was a lesson in adaptability and innovation. The “start small, think cosmic” philosophy guided his approach, turning failures into stepping stones for success.

For instance, the failure of ventures like Pets.com taught him the importance of diversification, leading to the creation of AWS. This shift not only saved the company but also became a major revenue driver. His ability to pivot and learn from setbacks is a key takeaway for aspiring entrepreneurs.

What Aspiring Entrepreneurs Can Learn from His Journey

His story offers valuable lessons for anyone looking to build a business. First, embrace failure as a learning opportunity. Second, focus on long-term goals rather than short-term gains. Third, invest in innovation, as seen in his current 95% time allocation to AI development.

- Quantify scale: 1M+ jobs created since 1994.

- Discuss failure-to-success ratio across ventures.

- Highlight current AI focus with 95% time allocation.

- Note divorce settlement’s philanthropic impacts.

His Earth Fund climate commitment further underscores the importance of using success to drive positive change. By balancing ambition with responsibility, he has set a benchmark for future leaders.

The Evolution of Jeff Bezos: A Look Back

From a humble garage startup to pioneering space exploration, jeff bezos’ journey continues to redefine innovation. The 1994 garage, where it all began, stands in stark contrast to his current 300K-acre ranch, symbolizing the vast scale of his success.

Today, he chairs Amazon while diving into AI and media ventures, rewriting the playbook once again. His focus on artificial intelligence mirrors the bold bets he made on web commerce in the early days. This forward-thinking approach keeps him at the forefront of the tech world.

Blue Origin’s lunar ambitions further highlight his relentless drive. The goal of making space travel accessible aligns with his lifelong passion for exploration. These ventures showcase his ability to blend vision with execution.

As a perpetual “Day 1” innovator, jeff bezos remains committed to pushing boundaries. His journey from a small business to a global company inspires countless entrepreneurs. The next years promise even more groundbreaking achievements, solidifying his legacy as a true pioneer.